Can Starbucks achieve its target for store growth?

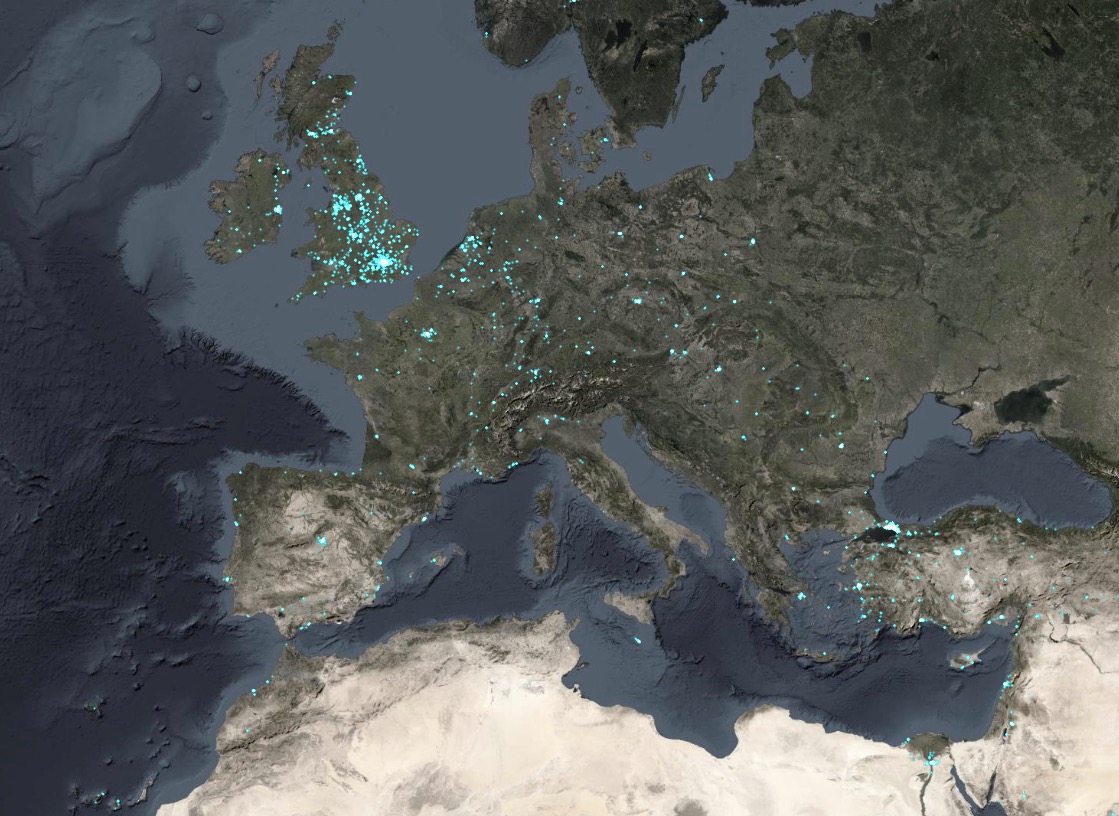

As of February 23, 2023, Starbucks had 36,011 stores worldwide, ranking it as the third largest player in the food service industry in terms of the number of locations, following McDonald's and Subway.

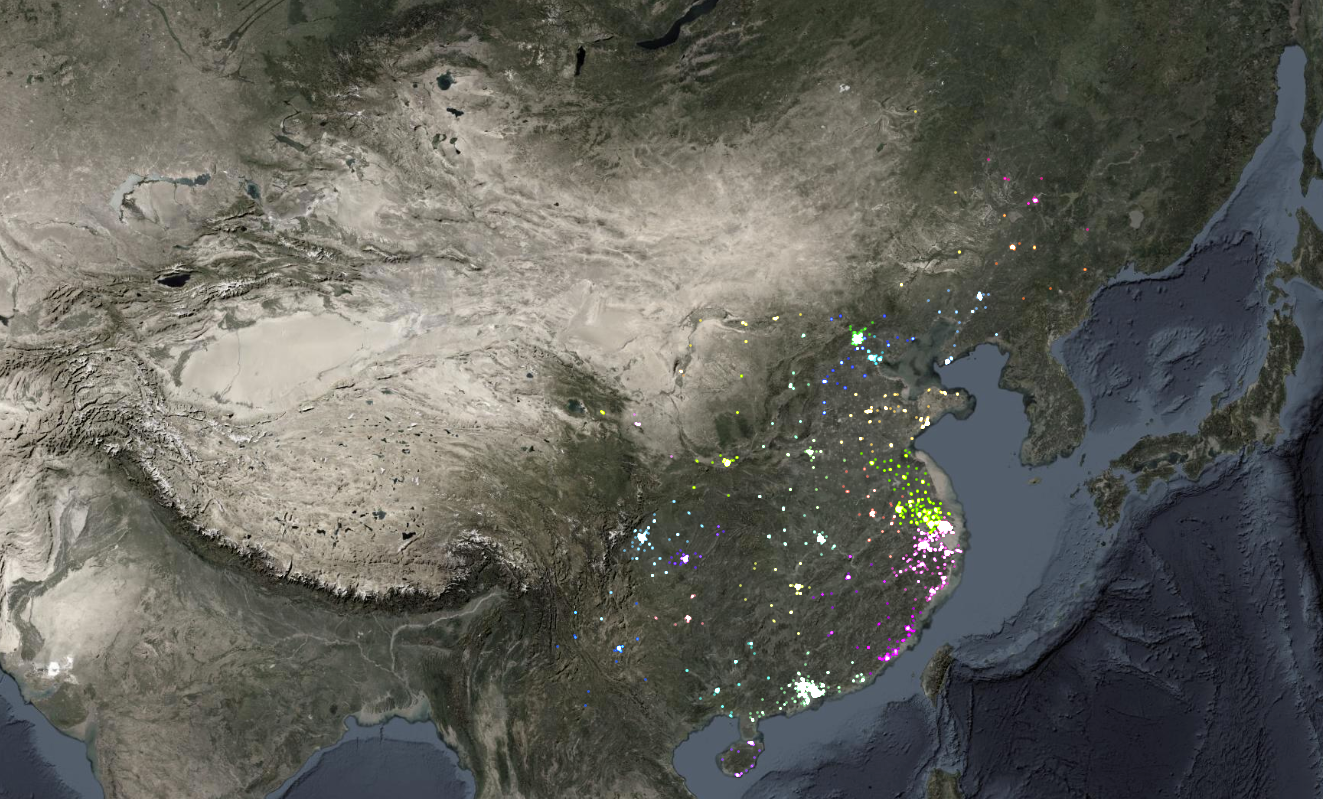

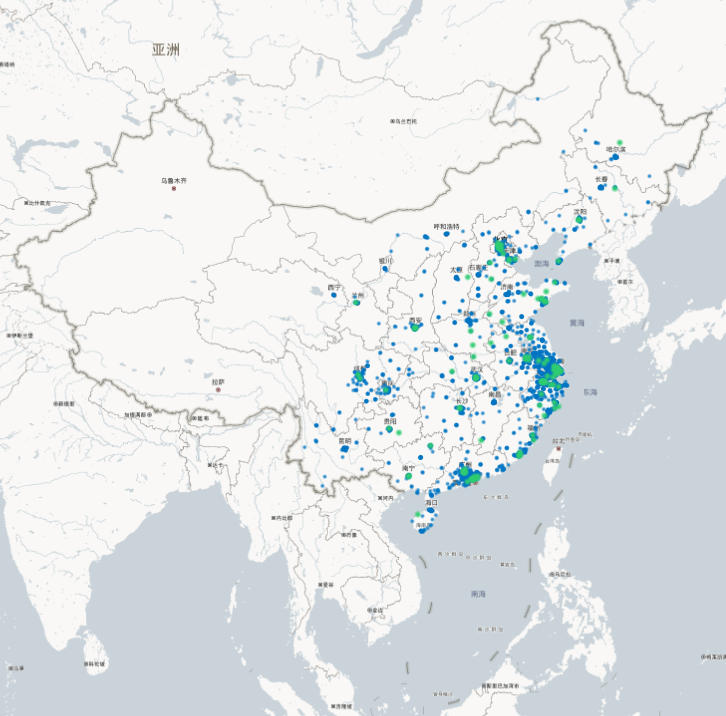

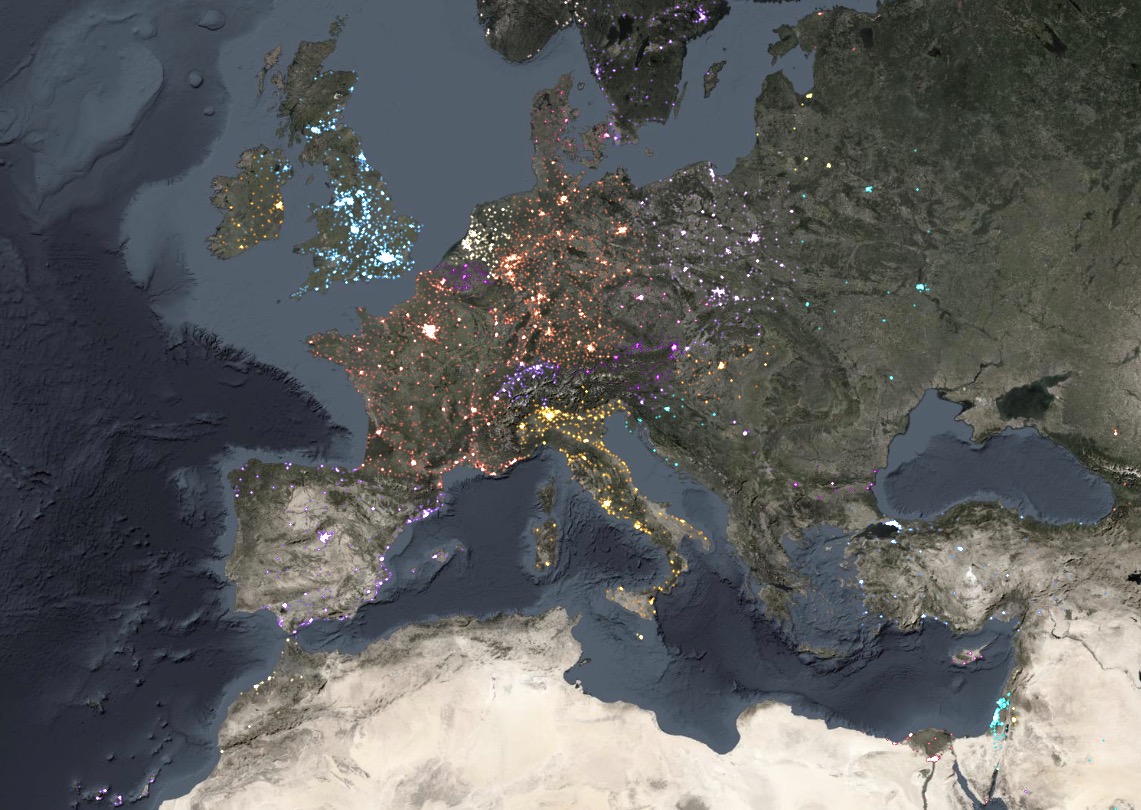

According to data from Geohey Brand Monitor (https://stores.geohey.com) as of the end of February 2023, Starbucks has 6199 stores operating in mainland China. These stores are located across almost all the cities and regions within the four main lines of the country.

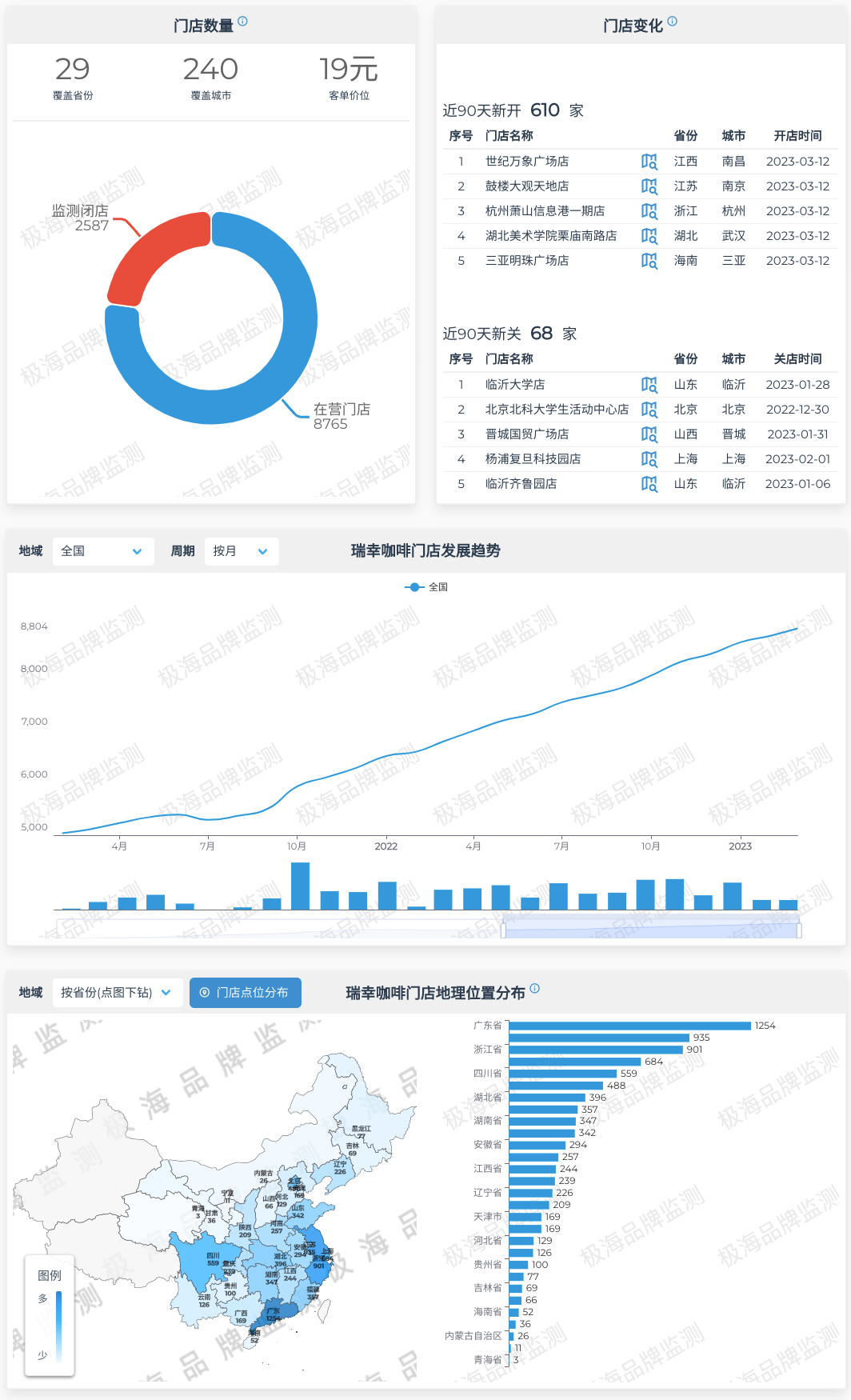

Despite widespread pessimism about 2022, Chinese mainland saw the opening of more than 600 new Starbucks stores, which represented a nearly 10% increase. This growth aligns with Starbucks' Strategic Vision for China 2025, unveiled at a global investor exchange conference on September 14 of the previous year, which sets a target of expanding the number of stores to 9000 by 2025, representing an increase of nearly 50%. This ambitious goal demonstrates Starbucks' strong aspirations in the Chinese market and underscores its commitment to making deeper inroads in China. However, this figure may seem less impressive compared to the 8765 stores operated by rival :luckin coffee.

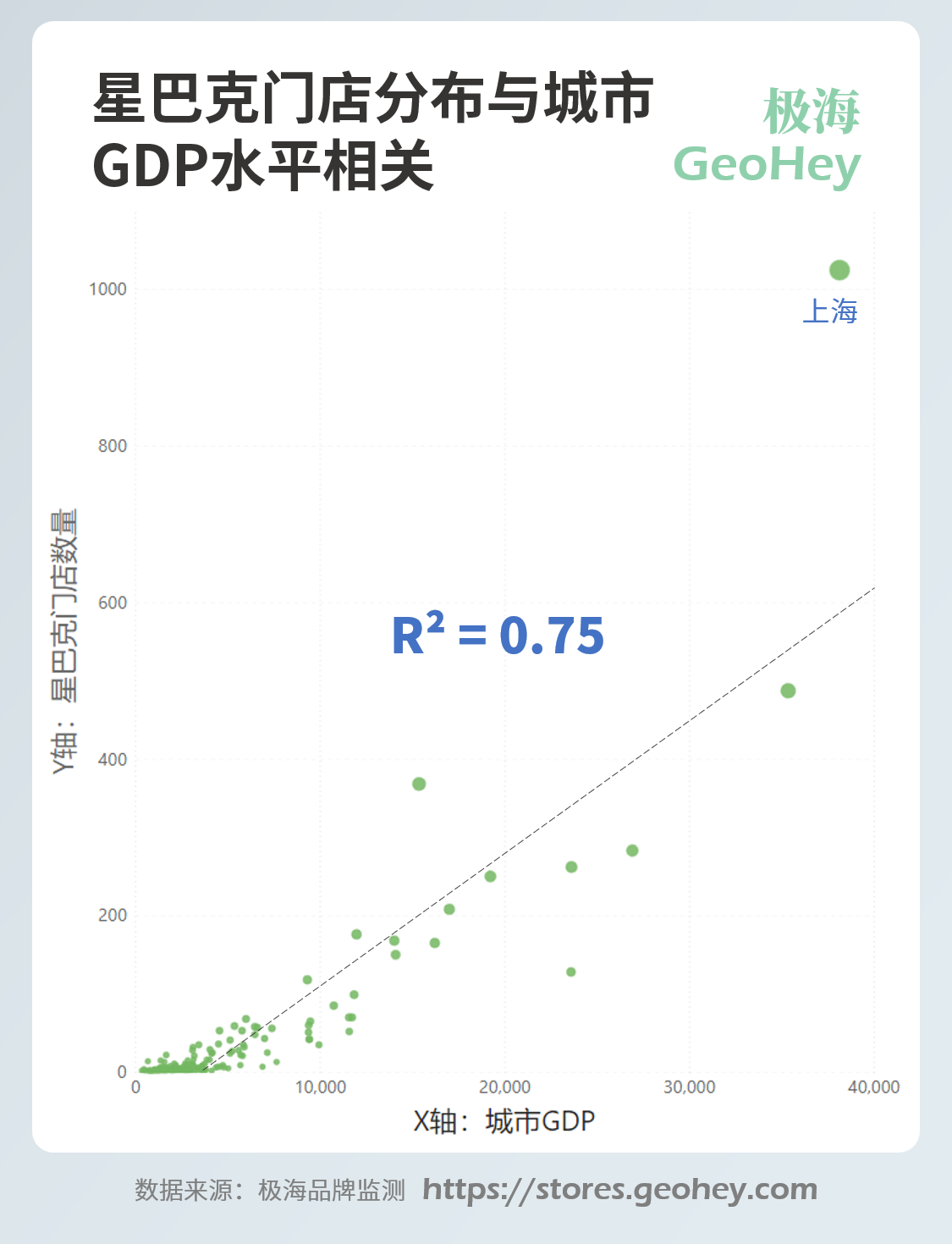

What factors determine the number of Starbucks stores that can be opened in a city? According to our previous Weixin public article (Success, Such as KFC, Depends on Innovation Strategy and Store Expansion), the market capacity prediction logic first conducts a regression analysis to determine the correlation between the number of stores and the GDP level of a city.

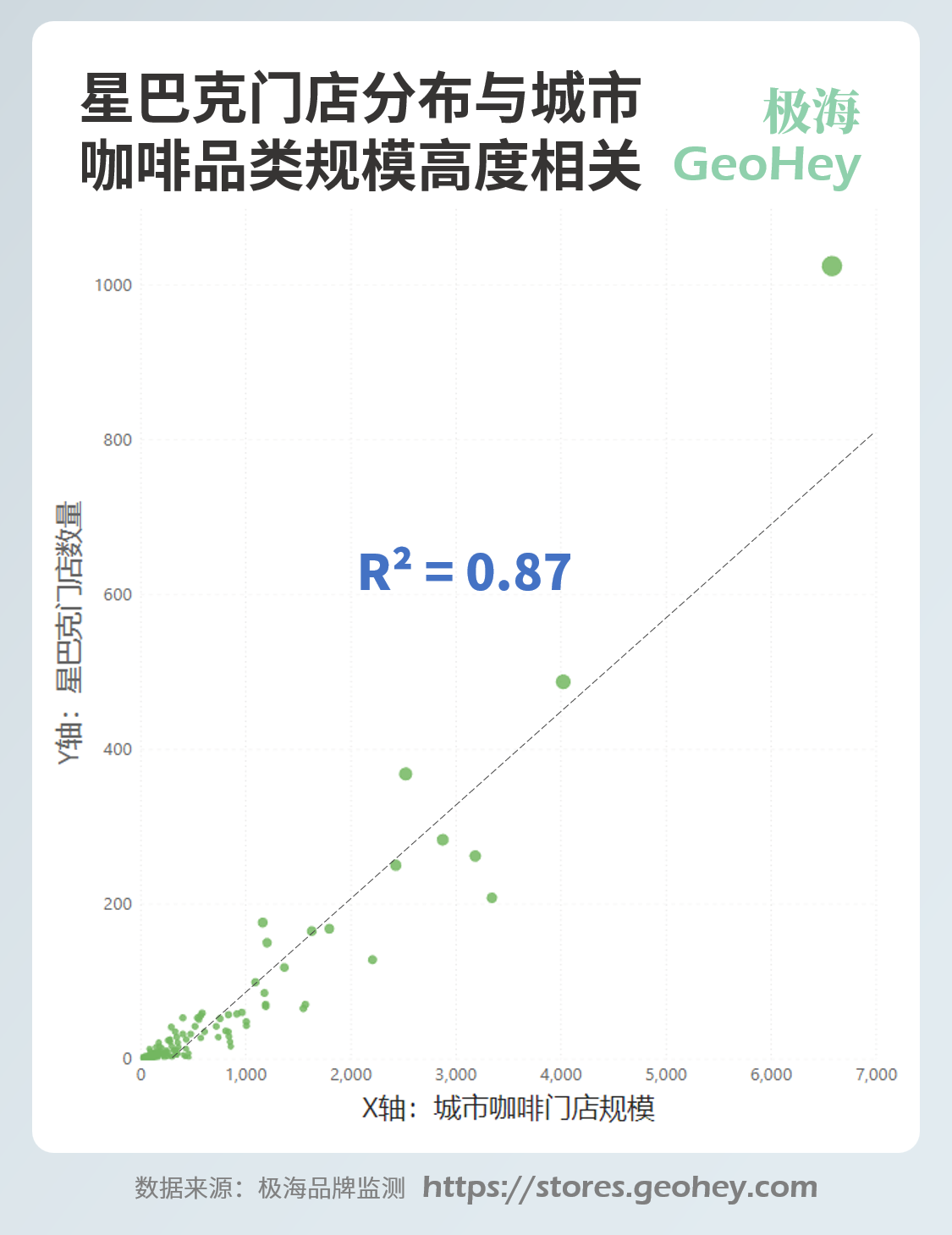

After testing and applying the formula available in Excel, the R² value for the correlation between the number of Starbucks stores and the GDP level of a city was 0.75. However, the R² value for the total size of coffee stores in a city (excluding Starbucks) was 0.87. As can be observed from the figure below, there appears to be a stronger correlation between the size of a city's coffee market and the number of Starbucks stores, as these cities are more closely aligned around a straight line.

This is a significant discovery, and it makes sense to consider it. As a foreign import, the potential for coffee expansion in China depends on the country's coffee culture and consumption habits. The number of coffee stores in a city, to some extent, reflects the coffee consumption habits of that city, making it highly correlated with the distribution of Starbucks stores.

Over generations, both big and small brands and entrepreneurs have worked tirelessly to explore the coffee preferences of each city. Currently, about 10 coffee shops can support one Starbucks, which roughly aligns with Starbucks' market share in the freshly ground coffee category.

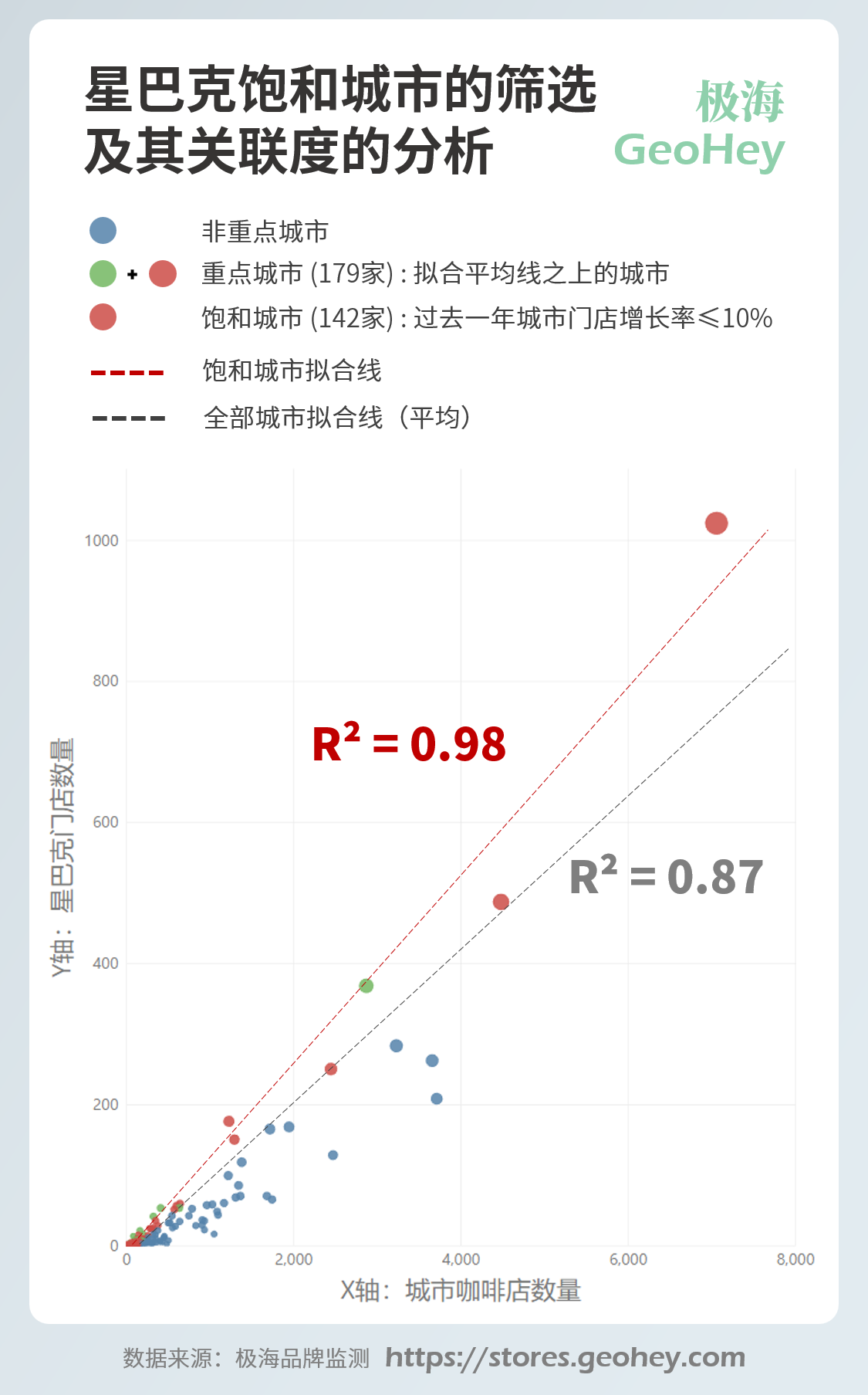

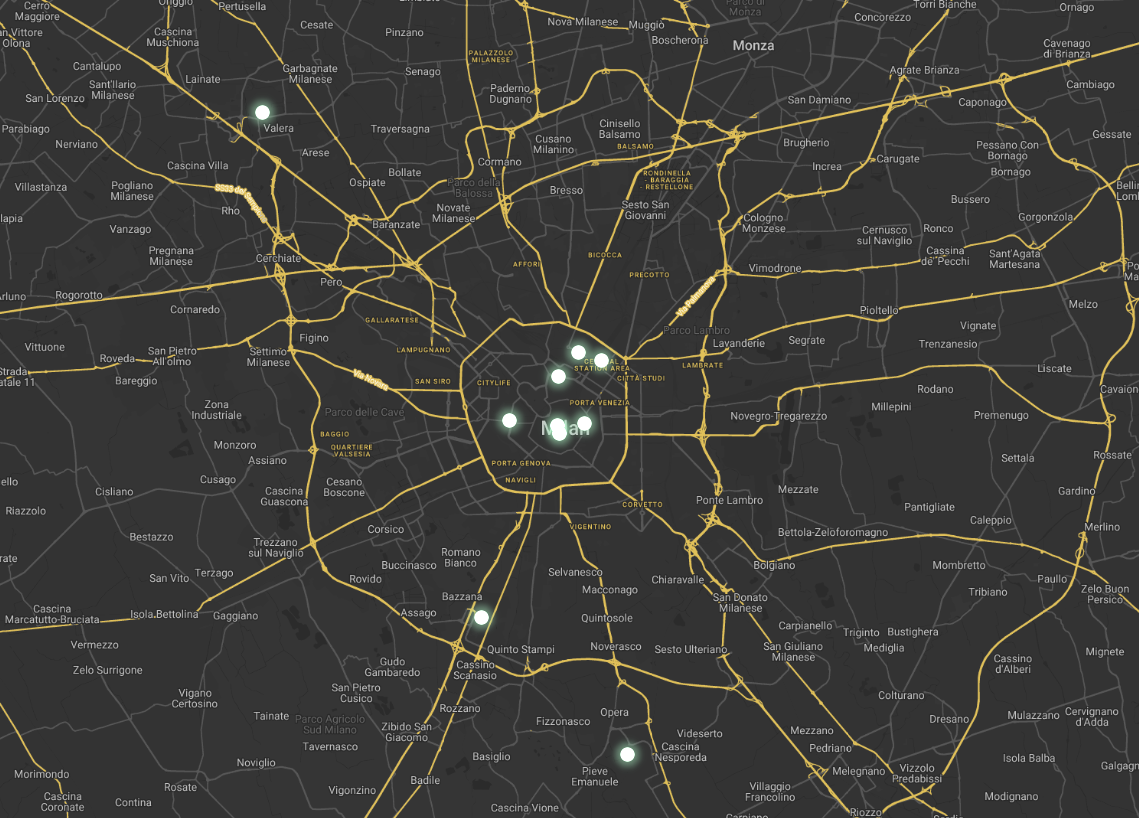

However, this is only the current situation. To predict future growth, we must not see the current state as an outcome. Instead, we must assume that some of these cities still have room for growth. To identify potential for growth, we need to find cities that are already highly saturated, determine rules that can be applied to all cities, and calculate how many more Starbucks can open if each city can reach saturation.

We can apply the law of saturated cities to measure the 142 cities where store growth has been lower than the overall average (10%) in Starbucks' key cities over the past year:

We can use linear regression to predict the gap between unsaturated cities and saturation by bringing all cities below the red saturation line up to this line. This means that all cities will reach basic saturation, and then we can count the total number of stores again. The estimated size of Starbucks stores is about 10,500 (an average of one Starbucks store per 7.50 coffee shops), and the potential for visible growth is 41%.

Therefore, the goal of 9,000 stores is not unrealistic. In fact, Starbucks China may be conservative in its expansion plan, as the management is more concerned about the efficiency of site selection and expansion rather than market capacity. While there is still room for growth, no one wants to open a new store that won't make money and cannibalize the business of their existing stores. Achieving the goal of 9,000 stores by 2025 at the rate of four stores a day will not be easy, especially with a proprietary model. An important consideration is whether to continue to concentrate stores in core cities or expand to the vast "sinking" market(rural market).

The common perception is that Starbucks' brand image and pricing strategy may not be appealing to the less developed regions of China. However, if you are uncertain about this, you can always ask ChatGPT. Although its response may be nonsensical, it may still provide some insight.

As the leading coffee brand in the world, Starbucks can draw on its experience in other markets and apply it to the Chinese market. The Chinese market holds great potential, as the acceptance of Western culture, including coffee and fast food, is much higher compared to traditional European markets.

In summary, to estimate the size of Starbucks stores in China, we have analyzed that the number of Starbucks stores in a city is closely linked to the overall size of the coffee market in that city. Unlike Italy and Spain, Chinese coffee drinkers are not a user group with a long-standing history, deep knowledge, and fastidious taste in coffee. Thus, Starbucks China must urgently identify cities with a thriving coffee culture to execute a rapid expansion plan, even opening over-saturated stores using their existing digital system. In the long term, as the leading coffee brand, fostering this culture remains a core strategy for sustainable development for both the company and its customers.